9 COUNTRIES - ONE VISION

WHO ARE THE BRICS NATIONS?

END-TO-END

Unveiling the BRICS: Investment Opportunities and Strategies in Emerging Economies

Navigating the Investment Landscape: Options for American Investors. Read more….

As BRICS economies boom, their rising currencies could reshape international trade flows and usher in a new era of financial power.

BRICS currencies are a double-edged sword for emerging markets.

Their rise can fuel domestic growth by attracting investment….

The BRICS alliance is challenging the dollar’s global grip.With more widely used BRICS currencies, international trade settlements can shift, leading to de-dollarization.

China’s economic might is the engine behind the BRICS currency initiative. China stands to gain the most, potentially establishing the Renminbi as a major reserve currency.

A unified BRICS currency could streamline trade within the bloc,

reducing transaction costs and boosting economic integration. However, achieving this ambitious goal requires overcoming significant hurdles…

Russia seeks to leverage a unified BRICS currency to lessen dependence on the US dollar and Western financial systems. This could bolster its economic security and trade ties with fellow BRICS members..

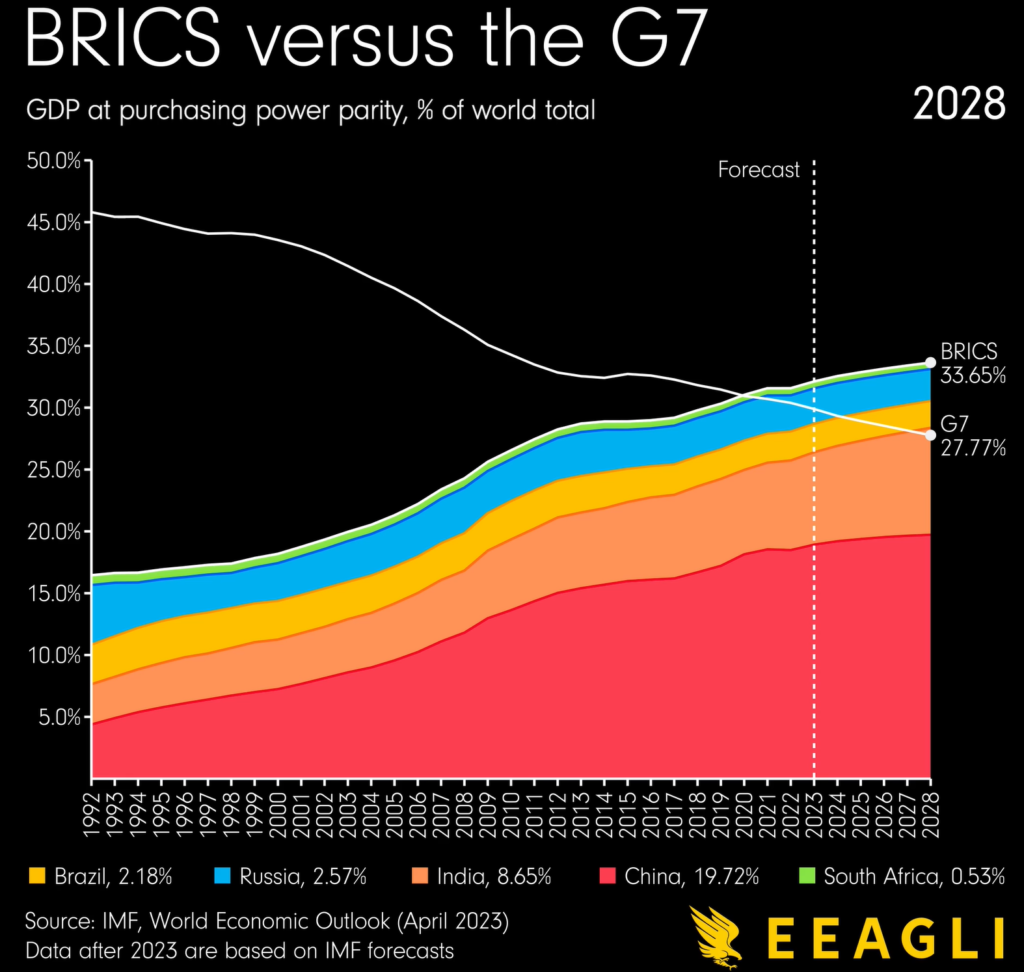

BRICS VS G7 PERFORMANCE

- Economic Growth: BRICS-Faster G7-Steadier

- GDP - BRICS Less Share of GDP but Gap Narrowing

- BRICS: Currencies Tend to be More Volatile vs. Dollar

- High Growth High Risk

- BRICS: Member States Face Political Instability vs G7

MORE ARTICLES?

CLICK HERE

Common Questions

The BRICS currency is a proposed unified monetary unit intended to facilitate trade and reduce reliance on the US dollar among BRICS nations.

The BRICS nations aim to decrease their dependence on the US dollar, gain more financial autonomy, and enhance trade stability within their block.

If implemented, the BRICS currency could shift trade dynamics by providing an alternative to the US dollar, potentially reducing transaction costs and exchange rate risks for member countries.

The main challenges include economic disparities among member nations, political differences, establishing a central regulatory body, and gaining international trust and acceptance.

A successful BRICS currency could diminish the global dominance of the US dollar by offering an alternative reserve currency, thereby diversifying global financial systems.

Potential candidates include emerging economies like Indonesia, Turkey, Nigeria, and others that are seeking to reduce their dependence on the US dollar.

Benefits include enhanced economic cooperation, reduced transaction costs, increased economic stability, and stronger collective bargaining power in global markets.

The valuation and regulation mechanisms are still under discussion, but it would likely involve a combination of fixed exchange rates, regulatory oversight by a central BRICS monetary authority, and possibly a basket of commodities or currencies.

As of now, there is no definitive timeline for the launch of the BRICS currency. Discussions and planning are ongoing, with many logistical, economic, and political hurdles yet to be addressed.

For Ways To Invest Click Here.